Contents:

You need to contact companies to find out whether they offer a direct stock purchase plan and what the terms and conditions are. These plans initially helped investors avoid brokerage fees, but the rise of online discount brokers with zero fees has removed this barrier, making the direct stock purchase plan somewhat of a relic. Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances.

This broker offers it all and does it at a high level, with remarkable customer service, too, especially by phone, where you can get an answer to your detailed question in seconds. Visit vanguard.com to obtain a prospectus or, if available, a summary prospectus, for Vanguard and non-Vanguard funds offered through Vanguard Brokerage Services. The prospectus contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing. However, your money is not insured against losses that result from declines in value of the investments in your account.

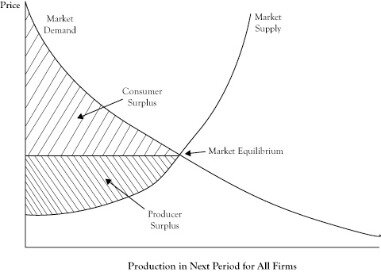

- Investing means buying and holding securities like stocks, bonds and ETFs to maximize returns in the long run.

- A taxable brokerage account offers the flexibility to have funds available when needed and without a tax penalty.

- Interactive Brokers earned a rating of 4.8 in for “Best Trading Experience and Technology”.

A stock broker is a financial professional who buys and sells securities on your behalf. Online stock brokers handle your transactions at a discounted cost, so they’re suitable for beginning investors with less money to spend. The best brokerage accounts for beginners are those that feature educational tools, low account fees, and intuitive mobile platforms. Discount brokers are increasingly online brokers that offer investors the opportunity to buy and sell securities at little or no cost.

Which trading platform is best for researching stock picks?

With an online broker, investors can trade anytime and anywhere. Additionally, they have lower commission fees and account minimums than traditional brokers, which helps make investing accessible to a wider range of people. This means that their securities account and fixed monthly payments into savings plans in ETFs or stocks are entirely free of charge.

The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced. Michael Rosenston is a fact-checker and researcher with expertise in business, finance, and insurance. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website.

That means if your best stock brokersage goes out of business, you are guaranteed to get your money and other assets back up to SIPC limits. You should consider opening a brokerage account if you’ve got money set aside that you don’t need at the moment. Whether you’re a DIY trader or hands-off investor, most brokerages allow you to place trades on your own or use an automated advisor for additional guidance.

Public.com Review 2023

In this case, you should consider the expense ratio, which is the percentage of your investment that goes toward paying annual fees. If your expense ratio is higher than your returns, it means you’re spending more than what you’re getting back. But if you mainly want to throw a wrench in the system and invest in meme stocks, then your platform should give you the freedom to do so too. Betterment’s main drawback is that it charges a $4 monthly fee for accounts under $20,000.

Your trading app will send you the code by either email or text, and you then type that code to gain access to your online account. Not only does it charge no commissions on options, but it doesn’t charge any per-contract fees either. TD Ameritrade has a high $49.99 fee for mutual fund trades off of the no-transaction-fee list. Before saving with a taxable account, consider the order of where you should save first to best accomplish your financial goals.

To learn more about our approach to content and product assessments, visit our Editorial Policy and Product Assessment Methodology page. Robinhood’s mobile trading platform had the highest average score among the two app stores, and their desktop interface tied for second as the most efficient to use. A key issue affecting the returns earned from margin investing is the interest rate you pay on the money you borrow. This becomes a hurdle you must clear in order to make money – i.e., the return on your investments must recoup the margin interest charges in order for you just to break even. The most recent MoneyRates Online Broker Survey found that the average flat-rate trading commission was $5.10. So by charging no commission on trades, the four firms above stand to save you over $5 every time you trade – and the more frequently you trade, the more money firms like these can save you.

Products

He concluded thousands of trades as a commodity trader and equity portfolio manager. One should start investing as early as possible, even if it is with a small amount of money. The magic of compounding is real and in the long run even this small amount can grow into a large amount. You should consider how much risk you are willing to take, and risk-taking also depends on the stage of your life cycle.

- Online stockbrokers, meaning companies like TD Ameritrade and Fidelity, allow you to buy and sell stocks.

- Importantly, Fidelity offers $0 commission for online stock and ETF trades, plus a high-quality mobile app that’s good for both beginners and seasoned investors.

- Interactive Brokers was rated “Best for Professional Traders”.

To maintain a large gap over the competition, the company is constantly innovating. More notable enhancements of late include a market rate interest paid on uninvested cash, the IBKR GlobalTrader mobile app, and the addition of fractional shares trading for European shares and ETFs. In addition, the company introduced the Fidelity Crypto Industry and Digital Payments ETF , along with a Fidelity Metaverse ETF . Enhancements also came to the institutional side of the business, with the company expanding access to some of its proprietary tools, like Fidelity Bond Beacon. With $3.6 trillion in discretionary assets as of December 2022, the Boston-based company ranks among the top brokerage firms in terms of assets under management. The thinkorswim mobile app allows you to trade stocks, options, futures and forex.

Best for Low-Cost Funds: Vanguard

For investors in the U.S., this is not a problem; but for investors living outside the U.S., it’s important to verify brokers offer service in your country. An online stockbroker should offer access to not only trading stocks, but also a strong selection of commission-free ETFs and the ability to analyze complex options positions. Other unique investment offerings to look for could include direct market routing, conditional orders, futures trading, and forex trading. Not surprisingly, the two biggest firms, Fidelity and Schwab/TD Ameritrade, offer the widest range of services—at low costs—and came out on top. Schwab’s robo-advisory, Schwab Intelligent Portfolios, doesn’t cost anything, which is a boon.

The three most common https://trading-market.org/ of orders are market orders, limit orders and stop-loss orders. We also include a side-by-side comparison between the advantages and disadvantages of self-managed trading platforms and robo advisors. However, unlike many trading platforms, Ally doesn’t offer fractional shares. In addition, it charges a 0.30% annual advisory fee for its hands-off robo portfolios and requires a $100 minimum to get started.

Ultimately, its reliable and competent representatives earned it the top spot for customer service. “We are proud to continue working with TradingView and look forward to what the future has in store, as we both continue to try to put traders first,” said Bartleman. When typing in this field, a list of search results will appear and be automatically updated as you type. Commerzbank – best for convenience for ETF saving plans, when also using the Commerzbank checking account or anyone wishing to use a traditional bank.

Trade Republic was founded in 2015 and is a German securities trading bank with its ownBaFin license. Trade Republic was the first company to launch a mobile-only trading app in 2019, allowing trading on the go. Next to the app, they are also revolutionizing the trading industry by offering commission-free trading. Having access to multiple investment vehicles lets you diversify your portfolio and reduce your risk. However, this doesn’t mean you should choose the platform with the most investment options, rather the one offering the choices that are right for your investment strategy.

Top insurance brokers, No. 10: Alliant Insurance Services Inc … – Business Insurance

Top insurance brokers, No. 10: Alliant Insurance Services Inc ….

Posted: Tue, 12 Jul 2022 07:00:00 GMT [source]

Compared to competitors in our list, SoFi selection of investment products is somewhat limited. For instance, its ETFs offering is mainly limited to SoFi’s own funds and Vanguard, and its crypto selection to a few popular options, like Bitcoin, Ethereum and Dogecoin. However, it’s a good option for newer investors, especially if you’re already familiar with SoFi’s banking products. Self-directed investors can choose a vast variety of ETFs, including equity and non-equity ETFs from a range of fund companies in the United States.

Stockpile offers brokerage and custodial accounts with no recurring fees, no minimums, and no gift card or funding fees. Trades are also free, and fractional shares are available starting with a $5 investment. Fidelity is one of the largest and one of the most well-rounded brokerages available in the U.S. today.

Some ETFs options include international ETFs, market-cap index ETFs, bond ETFs and currency ETFs. While all U.S. exchange listed ETFs are commission free, some operating expense fees may apply for some funds. Fidelity doesn’t charge account fees or require a minimum deposit for opening any of its brokerage accounts. In addition, it offers one of the lowest margin rates, at 8.50%.

Investopedia’s 2022 Best Online Brokers Awards – Investopedia

Investopedia’s 2022 Best Online Brokers Awards.

Posted: Wed, 05 Jan 2022 08:00:00 GMT [source]

Unlike mutual funds, which can have high investment minimums, investors can purchase as little as one share of an ETF at a time. Robinhood provides free stock, options, ETF and cryptocurrency trades, and its account minimum is $0, too. Mutual funds and bonds aren’t offered, and only taxable investment accounts are available. Still, if you’re looking to limit costs or trade crypto, Robinhood is a solid choice.

It stands out as an excellent, well-rounded platform that’s a great choice for active traders, long-term investors or people who are new to investing. To help you make the right choice, Forbes Advisor evaluated the leading online brokers to identify the best of the best. Our picks include platforms that are best for a range of different users, from self-directed investors to people who are just getting started. An investor may build a diversified portfolio with stocks, bonds, funds and alternative assets to meet a long-term goal like saving for retirement. They focus on portfolios that have the potential for long-term growth and provide them with exposure to the broader market. Investors may “ride out” market downturns because they believe they’ll recover losses and earn gains when the market rebounds.

Hollywood’s Top 30 Real Estate Agents 2022 – Hollywood Reporter

Hollywood’s Top 30 Real Estate Agents 2022.

Posted: Sat, 10 Sep 2022 07:00:00 GMT [source]

When it comes to trading on the go, I like customizing my watch list columns alongside flipping between multiple watch lists, setting price alerts, and occasionally streaming some video. For this reason, TD Ameritrade Mobile thinkorswim is my top pick for mobile trading. For non-active traders, TD Ameritrade also offers a second app, TD Ameritrade Mobile, which is also excellent (I highly recommend the stock education videos!). This broker has low prices, comprehensive tools and the ability to trade in 33 countries.

Then, as you evolve as an investor and your needs change, check back with MoneyRates to see how online brokers have adapted to this rapidly changing field. Serious investors try to gain an edge by doing their own investment research, and some online brokers do more than others to facilitate this. Like Firstrade, Robinhood represents an attractive entry point for smaller investors because they have no commissions, monthly maintenance fees, inactivity fees, or minimum account size. A high minimum-investment requirement may shut out smaller investors while high commissions or fees represent a higher percentage of small accounts and thus take a deeper bite. I trade the major Forex pairs, some Futures contracts, and I rely entirely on Technical Analysis to place my trades. I began trading the markets in the early 1990s, at the age of sixteen.

Recent Comments